A Beginner’s Guide On How to Calculate Zakat

It is the month of Ramadan, and at this time many of us are wondering how to calculate Zakat. But let’s take a step back and take the time to appreciate, what is Zakat? Why does it hold such importance in Islam?

At a time when many services and businesses are restricted, when borders are closed and many people’s livelihoods are uncertain, charities continue to provide aid and support. All over the world, humanitarian organizations are trying to make sure the most vulnerable people are not overlooked during this pandemic.

But they wouldn’t be able to operate without the generosity of people who are willing to give at a time of crisis. As Muslims, giving charity is more than a means of earning Allah’s pleasure, it’s also an obligation and a right we must fulfill, known as Zakat.

“Those who put aside from their wealth a known right for the needy and the poor… they are honoured in Gardens of Bliss.”

Quran 70:24-35

To help you fulfill this important obligation, we’ve put together this beginner’s guide to Zakat. In the next sections, we’ll cover everything you need to know to get started. The topics we cover will include:

- What is Zakat?

- What is Nisab? How do I know how much it is?

- How is Zakat used? Who receives your Zakat?

- How do I know if I need to pay Zakat?

- How do I actually calculate Zakat?

- Additional resources on Zakat.

What is Zakat?

So what exactly is Zakat? The technical definition of Zakat is a charitable donation made by Muslims, calculated as 2.5% of their surplus wealth. In simple terms, Zakat is calculated as 2.5% percent of your savings and financial assets that are not used towards your living expenses.

Any income used to pay bills, house payments or essential needs is not included in the calculation. There are a couple other criteria to meet when trying to figure out how to calculate Zakat – or if you meet the threshold to pay at all. You can see the details in our Zakat Guide Booklet.

And What Exactly is Nisab?

Nisab is the minimum amount of wealth that acts as a threshold to determine whether Zakat is obligatory on you. If what you own is more than Nisab, then it means you are eligible to pay Zakat that year. If it is less, then you don’t need to pay Zakat.

In Islamic Law, the threshold of minimum wealth (Nisab) is determined by two set values, 3 ounces of gold or 21 ounces of silver. Since we no longer deal with gold and silver as our currency, we can calculate their cash value online.

Gold

The Nisab by the gold standard is 3 ounces of gold (87.48 grams) or its equivalent in cash. You can calculate this online, by multiplying the number of grams by the current market value of gold.

Silver

The Nisab by the silver standard is 21 ounces of silver (612.36 grams) or its equivalent in cash. You can calculate this online, by multiplying the number of grams by the current market value of silver.

Wondering which Nisab threshold you should use, gold or silver? In the Hanafi school of thought, the silver standard is predominantly used to ascertain the Nisab threshold and eligibility to pay Zakat.

However, there are contemporary scholars within the Hanafi school who recommend using the gold standard, especially in today’s age where the cost of living is high and the value of silver has significantly decreased. The other schools of thought use the value of gold. You can choose to use the silver standard if you would like to increase the amount of charity distributed.

How is Your Zakat Used?

Zakat is so much more than a yearly obligation. It’s a revolutionary concept with the potential to ease the suffering of millions around the world. It’s so important in our religion that it is mentioned over 30 times in the Quran, and very often together with the establishment of prayer.

Allah (swt) defines the true believers as those “who are steadfast in prayer and give Zakat.” (Quran 5:55) Because of this, we are set apart as a people who strive not only toward inner refinement but also public service – through our Zakat.

How then is your Zakat used to change lives? The purpose of Zakat is to make sure the poor and the needy, the vulnerable and the disadvantaged are looked after. It’s meant to ensure that our collective wealth finds a way to those who need it the most.

At Islamic Relief, we strive to distribute your Zakat in a way that empowers people to break the cycle of poverty. Our goal is to provide relief, and ultimately bring people out of their difficult circumstances by helping them become financially independent.

Who Receives Zakat?

Muslim scholars derive the eligibility of Zakat based on the following verse in the Quran:

“The prescribed alms are meant only for the poor, the needy, those employed to administer the funds, those whose hearts are reconciled to the faith, for freeing slaves and helping those in debt, for God’s cause, and for travellers in need. This is an obligation from Allah. And Allah is Knowing and Wise.”

Quran 9:60

We can see there are eight categories of people who can receive and benefit from the Zakat collected. In current times, and in the given state of the world, Zakat is primarily given to these first two categories, because for them the need is greatest and most urgent.

We identify those who are well below Nisab, working with the poorest of the poor and those who are most vulnerable in the face of conflict and disaster. This includes orphan households, single female-headed households, people with disabilities, and the elderly.

How Do I Know if I Need to Pay Zakat?

Like any other obligation in Islam, Zakat is only mandatory if certain conditions are met. As we know, Allah (swt) does not burden a soul with more than it can bear.

The majority of scholars agree the basic conditions for Zakat are that it is mandatory for Muslim adults, of sound mind, who own the minimum amount of Zakatable wealth, or Nisab, for at least one lunar year.

You should know there are some schools of thought who put forward that Zakat is also due upon minors who have wealth or inheritance if they meet the other conditions: Muslim, complete ownership of the wealth for one lunar year, and meet the Nisab threshold.

Of course, this doesn’t apply to children’s allowances or Eid money, but rather applies to minors with trust funds and inheritances. The details and technicalities are beyond the scope of this blog post, but you can consult with your local scholar for more details. We just wanted to make you aware of this possibility.

How Do I Actually Calculate Zakat?

Just like taxes, knowing how to calculate Zakat is pretty straightforward in most circumstances. The basic formula is as follows:

1. Total up all your sources of income:

Tally up all the assets that you have owned for the past year. This includes:

Cash + Gold & Silver + Debts Owed to You* + Investment Property* + Shares & Stocks* + Investment & Saving Funds* + Business Assets* = Your Total Income

Those above marked with an asterisk (*) have some special considerations and instructions. Consult our Zakat Guide Booklet for details.

2. Total up your immediate needs and living expenses

This includes:

Personal & Living Expenses + Debts You Owe* + Business Expenses* = Your Living Expenses

Those above marked with an asterisk (*) have some special considerations and instructions. Consult our Zakat Guide Booklet for details.

3. Find out your total Zakatable Wealth

Your Total Income – Your Living Expenses = Your Zakatable Wealth

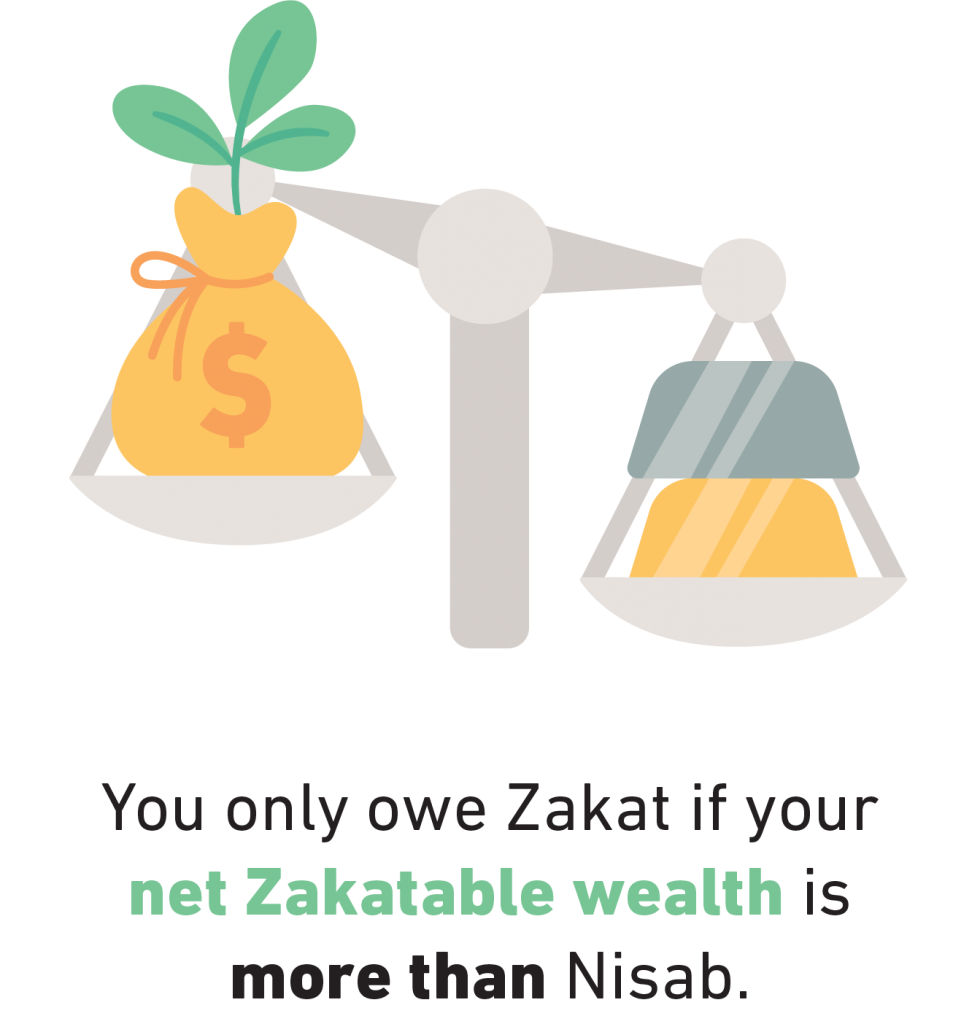

4. Check if it’s above threshold for Nisab

Whether you decided to go with the gold or silver value for Nisab, determine the current cash value of your Nisab threshold.

If your Zakatable Wealth is more than the Nisab threshold, then you can move on to the next step!

5. Calculate how much Zakat you have to pay:

Your Zakatable Wealth x 2.5% = Total Zakat You Owe for the Year

We hope this helps you understand the fundamentals of how Zakat is calculated!

To make the calculation easier, you can use our Online Zakat Calculator, where you can just plug in your numbers. It will even calculate the value of your gold and silver automatically.

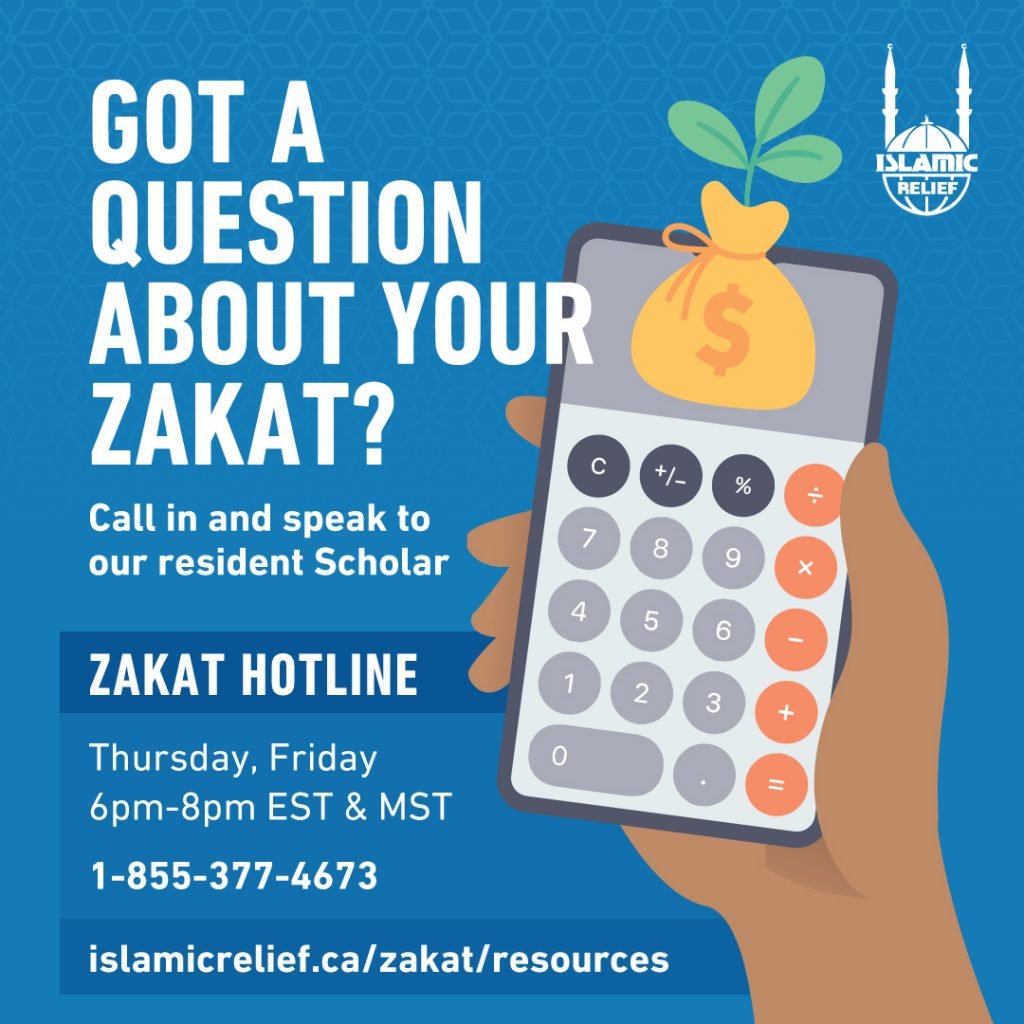

What if I’m Not Sure How to Calculate Part of It?

Of course, like taxes, everyone’s circumstances vary, and we understand that people want to be extra careful when determining how to calculate Zakat. This can be even more complicated (or comprehensive, because our strength lies in our ability to be multi-faceted) when you take in differences of scholarly opinion.

We’ve done our best to provide answers to frequently asked questions like when to pay or if you can pay in instalments, as well as give details that you may be looking for through our complete Zakat Guide Booklet.

During Ramadan, we also have a Zakat Hotline that is open every Thursday and Friday from 6:00 pm – 8:00 pm (EST & MST).

Simply call us at 1-855-377-4673, and your queries will be answered by our resident scholar who is well-versed in the rules of Zakat and the major schools of Islamic law.

We hope this blog has given you the confidence and tools for how to calculate your Zakat! Whether it’s something you’re doing for the first time, or something you do every year, we hope that we have helped you fulfill this beautiful opportunity with excellence.

Through this momentous act of worship, we pray that we can draw closer to Allah’s pleasure and mercy and together bring healing to those most in need.

“Whoever relieves the hardship of a believer in this world, Allah will relieve their hardship on the Day of Resurrection. Whoever helps ease a person in difficulty, Allah will make it easy for them in this world and in the Hereafter…”

Prophet Muhammad ﷺ